A $250 Trillion use case for blockchain

And that's just one of many use cases.

Hey there 👋!

I blog to help you appreciate web3 in 5 minutes with:

simple and structured writing

visual mental models

bullet points

the ‘so what’

If you’re a time-poor critical thinker with no patience for long paragraphs, welcome home!

The world today is hyper convenient. At a push of a button, I can order anything and have it at my door in days. Often, shopping even comes from the other side of the world. At the same time, my cash also travels around the globe.

From $150 Tn in 2017, the Bank of England estimated global cross border payments to grow to $250 Tn by 2027. I can’t even fathom that amount of cash 🤯

In this post, I want to convince you that blockchain is inevitable because:

Cross border payments are a big deal $$$, but

It’s inefficient and ripe for disruption, while

Blockchain tech is a perfect fit for the problem

And that’s just one (multi-trillion-dollar) use case!

Cross border payments are more than just your international shopping bill

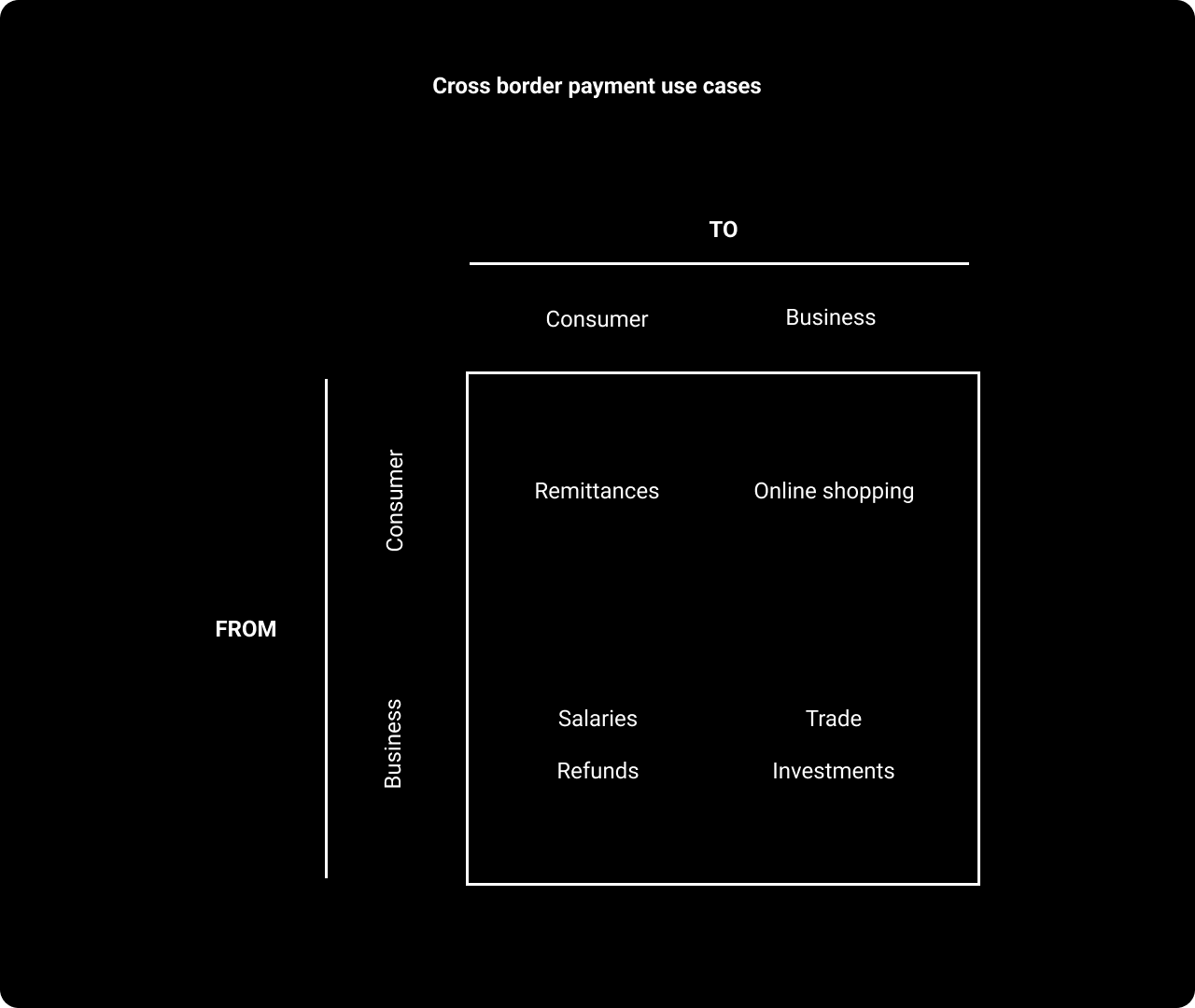

From a retail perspective, the familiar use case for international money transfers are probably remittances. Examples are Western Union, Revolut, and TransferWise. To expand the definition, here’s a 2x2 matrix:

A majority of the business comes from B2B transfers. In 2017, ~57% of revenues1 from cross border payments came from B2B.

International payments are crazy complicated, slow, and expensive

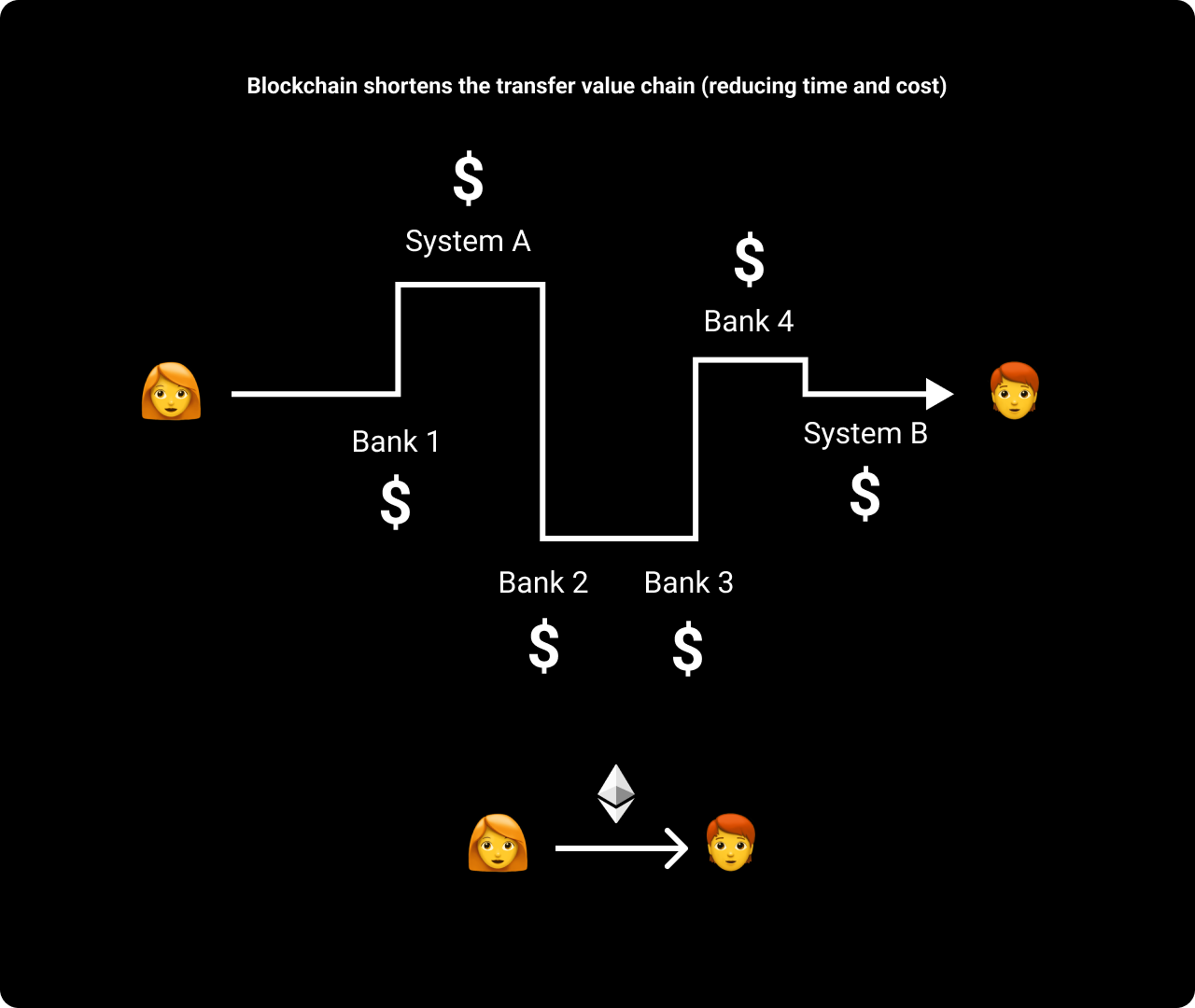

Below is a chart on how one version of international payments work.

It’s a busy chart. Here’s how the model works in a nutshell:

Alice in Tokyo wants to send money to Bob in Mexico

Alice talks to her bank in Japan (Bank A)

Bank A needs a bank with international capabilities (Bank B)

Bank B talks to their counterpart (Bank C)

Bank C then talks to Bob’s bank (Bank D)

Bob in Mexico, finally, gets his money.

A few insights here:

Not all banks are equal—only a few have international payment facilities!

Therefore other banks have to work with (i.e. pay) these banks

Each step costs money, time, and potentially, mistakes

There are other systems for international payments aside from the correspondent banking model above like the closed-loop model, interlinking model, and peer-to-peer model. You can read more about it in a great report from the BIS (Bank for International Settlements) here.

Most traditional systems today have the same problem: it involves many steps, separate systems and standards, as well as middlemen which results to more fees and time spent unnecessarily.

This isn’t novel. McKinsey thinks the cost of international transfers will be reduced from ~$25 to only $1 is possible. Oliver Wyman also believes global transfer costs could be reduced by 80% from $120Bn to only $20Bn with the introduction of CBDCs (Central Bank Digital Currencies).

Blockchain to the rescue

So, why will blockchain fix this problem? It addresses multiple pain points of the current international payments system2. Below are some examples:

Different payment systems - Japan and Mexico likely have different financial technology and standards. When you move money between the two, the inconsistency costs time and money. With blockchain, everyone can use the same system

Manual work - Legal and compliance requirements (e.g. KYC) also cost time and money. Blockchain tech gives us the opportunity to automate controls.

Transparency - Would a bank allow another bank to get access to their records? Probably not. Blockchain is a distributed and public ledger which allows transactions to be easily accessible.

Foreign exchange risk - Banks charge consumers extra because they take on the risk of foreign currencies changing prices while the transfer is pending. Transactions are close to instant on the blockchain, so this risk (and cost) can be minimized.

Messaging - Electronic payments require the exchange of electronic messages (e.g., the payor and payee’s account information). Different jurisdictions could have different standards. What happens when the message doesn’t have the information a country needs? Delays. Blockchains help by making it easy to have a standard set of data!

Disclaimer: Global payment systems are complicated. For the purposes of this publication, I’ve kept the information and concepts high-level. If you are interested in a deep-dive discussion, send me an email or comment below so we can discuss!

So what?

$250 trillion dollars could be going through international payments alone.

Blockchain is a great solution

In 2021, Ethereum processed only $11Tn in transactions

Imagine other use cases beyond global payments

Web3 is still in its very early stages. Imagine what a mature web3 industry looks like.

Share the insight!

If you liked this piece, you can show support by:

+ Following me on LinkedIn: Nigel Lee and click the 🔔 button

+ Following me on Twitter: @nigelwtlee

+ And of course, subscribe for more!

A vision for the future of cross border payments, McKinsey & Company

Where do you see government's role/currency controls? is the blockchain running essentially p2p and superseding banks, who have to play by the rules? or new banks (or whatever) pop up to handle this?